Australia’s Engineering Consulting industry has seen significant growth in recent years, reflecting increasing demand across various sectors. Whether you're curious about the industry’s expansion or need insight into how the number of businesses has evolved, this article breaks down the current landscape and forecasts future trends.

Engineering Consulting in Australia: Current Numbers and Trends

As of 2024, there are 46,513 engineering consulting businesses operating across Australia. This represents a 3.8% increase from the previous year and highlights the growing importance of engineering services in the country. The industry has been expanding steadily, driven by rising demand in sectors such as construction, mining, and public infrastructure.

Over the past decade, the number of engineering consultancies has risen dramatically. In 2014, there were 31,270 businesses, and by 2024, this figure had grown to 46,513. This reflects a robust annualised growth rate of 3.8% from 2019 to 2024. The consistent increase is expected to continue in the coming years as more projects require expert engineering consultation.

A Look Back: Engineering Consulting Growth (2014–2024)

Here’s a quick overview of how the number of engineering consultancies in Australia has changed over the years:

- Feb 2014: 31,270 businesses

- Feb 2016: 33,292 businesses (+6.47%)

- Feb 2018: 36,513 businesses (+9.68%)

- Feb 2020: 39,463 businesses (+8.08%)

- Feb 2022: 43,940 businesses (+11.34%)

- Feb 2024: 46,513 businesses (+5.86%)

The steady upward trend reflects the resilience and growing demand for specialised engineering services.

What’s Driving This Growth?

Several factors contribute to the expansion of the engineering consulting sector:

- Increased Capital Expenditure: Large-scale construction and infrastructure projects funded by both public and private sectors are fueling demand for engineering expertise.

- Technological Advancements: Engineering consultancies are increasingly needed to provide specialised services involving cutting-edge technologies, including AI-driven processes, smart infrastructure, and renewable energy projects.

- Economic Growth: As Australia’s economy grows, so does the demand for engineering services, particularly in sectors like mining, real estate, and public utilities.

The Australian Government is heavily invested in capital expenditure for large-scale construction and infrastructure projects across the country. For the 2024-25 budget, the federal government committed $16.5 billion towards new and existing infrastructure projects, focusing on driving growth in cities and regions (Infrastructure Investment Program).

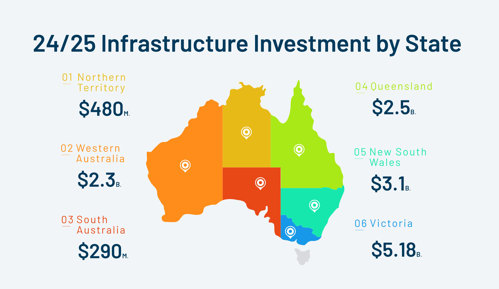

Here's a breakdown of how much each state is investing:

New South Wales:

- The Australian Government has committed over $3.1 billion to transport infrastructure projects in New South Wales, with an additional $2.5 billion dedicated to upgrading key road and rail networks. Major investments include $500 million for the Mamre Road Stage 2 Upgrade, $400 million for the Elizabeth Drive Priority Sections Upgrade, and $220 million for the Circular Quay Renewal Program. These projects aim to enhance urban connectivity and prepare the state for future population growth.

Victoria:

- Victoria will receive over $5 billion for infrastructure development in 2024-25, with a strong emphasis on the North East Link, to which an additional $3.25 billion has been allocated. This major project is aimed at addressing transport bottlenecks, improving travel times, and boosting economic productivity. Smaller investments, such as $12 million for upgrades to the Bridgewater Road and Portland Ring Road intersection, will also contribute to improved road safety and traffic flow across the state.

Queensland:

- With the upcoming 2032 Brisbane Olympics in mind, Queensland will benefit from over $2.5 billion for new and existing infrastructure projects. Key developments include an extra $1.15 billion for the Direct Sunshine Coast Rail Line, and funding for multiple road upgrades such as $134.5 million for the Warrego Highway Mt Crosby Road Interchange Upgrade. These investments are designed to support the state's rapid growth and economic development.

Western Australia:

- Western Australia is set to receive over $2.3 billion in the 2024-25 budget. This includes $300 million for the METRONET: High-Capacity Signalling Program and $495 million for regional road safety upgrades and new projects such as the Great Northern Highway – Fitzroy to Gogo road reconstruction. These efforts aim to enhance the state's mining and transport infrastructure.

South Australia:

- South Australia’s infrastructure spending will include $290 million for vital transport projects, such as $120 million for Mount Barker and Verdun Interchange Upgrades. This forms part of a broader $9.7 billion commitment over the next ten years, focusing on enhancing the state's connectivity and resilience against environmental risks.

Northern Territory:

The Northern Territory will benefit from over $480 million in new infrastructure investments, primarily directed at road upgrades like $72 million for the Port Keats Road – Wadeye to Palumpa project and $64 million for the Arnhem Highway Duplication. The projects are aimed at improving access to remote communities and enhancing the resilience of critical transport corridors.

These investments not only address transport but also focus on environmental sustainability, with projects increasingly aligned with the country's Net Zero targets (Build Australia). This push for infrastructure development aims to meet current needs while preparing for future growth and sustainability.

The Australian Government has made significant investments in both real estate and public utilities since 2023, focusing on infrastructure that supports housing and essential services.

Real Estate Investment:

As part of the 2024-25 federal budget, the government has allocated a total of $32 billion towards housing initiatives, building on previous investments since 2022. This includes $6.2 billion in specific housing programs aimed at addressing housing pressures. A further $1 billion has been made available to states and territories for enabling infrastructure like water, power, and roads, which supports the delivery of new housing (Budget 2024-25).

Public Utilities Investment:

Public utilities, particularly those related to water, power, and sewerage, have also seen significant funding. The government has committed to improving public utility infrastructure in urban and remote areas. For instance, in the Northern Territory, $4 billion is being invested jointly with the state government to address housing and utility infrastructure, particularly in remote areas (Budget 2024-25).

Geographic Distribution: Where Are Most Consultancies Located?

The states with the highest number of engineering consulting businesses are:

- New South Wales (NSW): Leading with the largest number of engineering consultancies, thanks to significant infrastructure projects like the Sydney Metro and the Western Sydney Airport. NSW continues to be a hub due to its diverse economy and extensive urban development.

- Victoria (VIC): Close behind NSW, Victoria benefits from large-scale projects such as the Suburban Rail Loop and other urban infrastructure projects. The state's focus on transport and housing initiatives has significantly contributed to the rise in consultancies.

- Queensland (QLD): Queensland also has a substantial number of engineering consultancies, many of which are expected to be supporting preparations for the Brisbane 2032 Olympics and various transport infrastructure upgrades.

- Other states like Western Australia (WA), South Australia (SA), and Tasmania also contribute to the national total, particularly with growth in sectors such as mining, energy, and renewable projects.

Future Outlook

Looking ahead, the engineering consulting industry is expected to maintain its upward trajectory, supported by continuous infrastructure investments and technological advancements. With no signs of slowing down, the industry will remain a critical component of Australia’s economic fabric well into 2030.

The engineering consulting industry in Australia is not only expanding but also evolving in response to market needs. From 31,270 businesses in 2014 to 46,513 in 2024, the sector's robust growth is a testament to the rising demand for specialised services. Whether you're in the industry or looking to start a new venture, understanding these trends is essential for capitalising on future opportunities.